Case Study

Online Banking

Online banking presents to the user as a single product, but in fact it is a collection of many smaller products that work together. There are separate versions of the online banking product for personal banking, small business banking and corporate banking. This case study will focus on Personal banking.

The User Problem Defined

Similar to the credit unions' public sites, the credit union online banking platform was based on an aging technology stack which was only available on desktop computers. Support for mobile platforms was extremely limited.

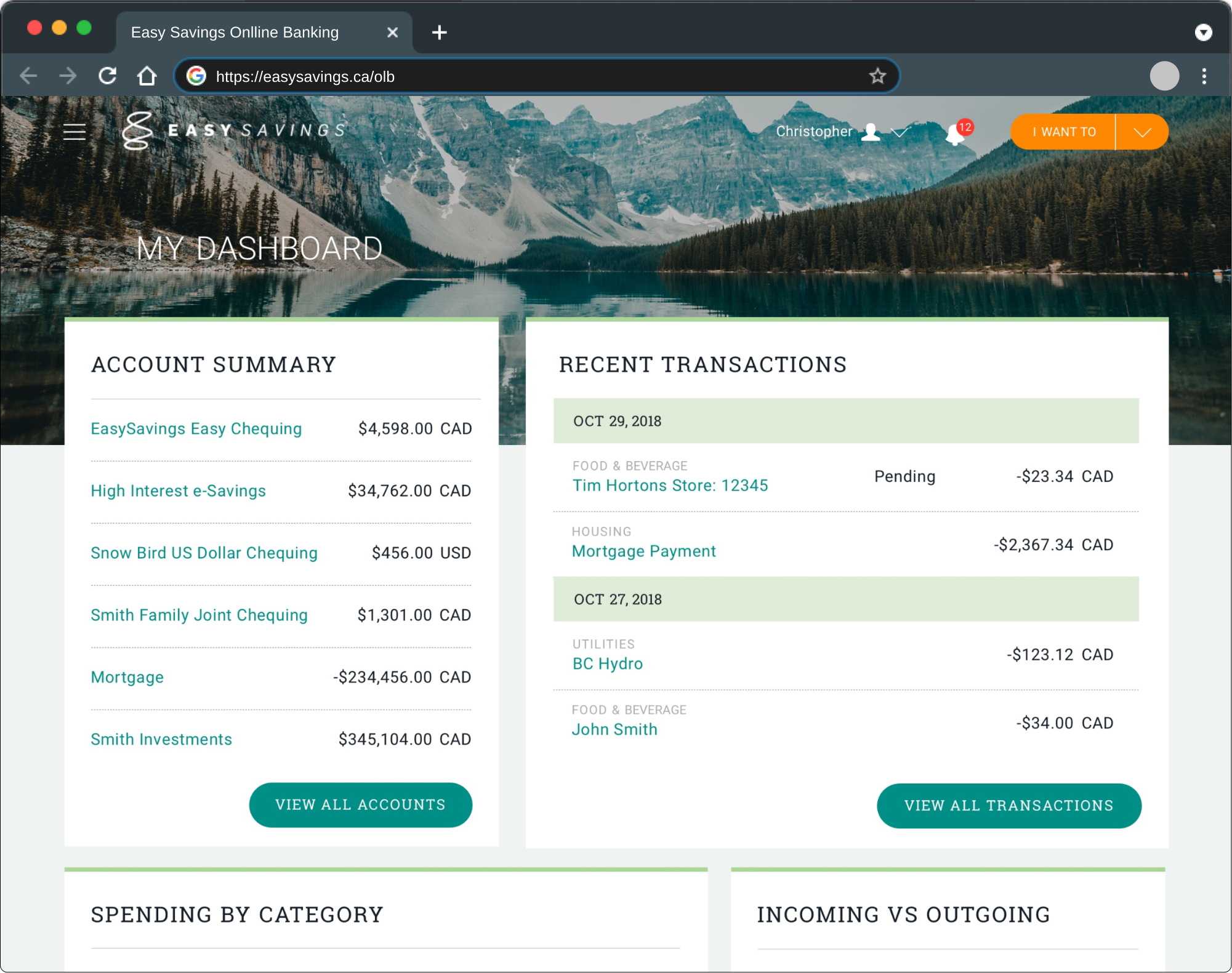

The credit unions needed a modern responsive online presence that is responsive for mobile platforms, incorporates new features, and is extensively brand-able. The Forge product is a scalable, multi-tenant solution to modernize the design and features of online banking for credit unions ranging in size from the smallest local credit unions to the very largest in the country.

Observations

From our users we heard that the existing product looked dated.

Younger users especially felt that the interface was out of date, and it didn’t inspire them to believe that the existing product was a banking platform that they could rely on.

The Design Process

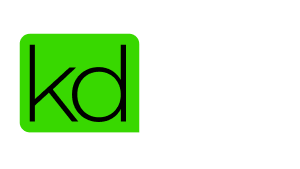

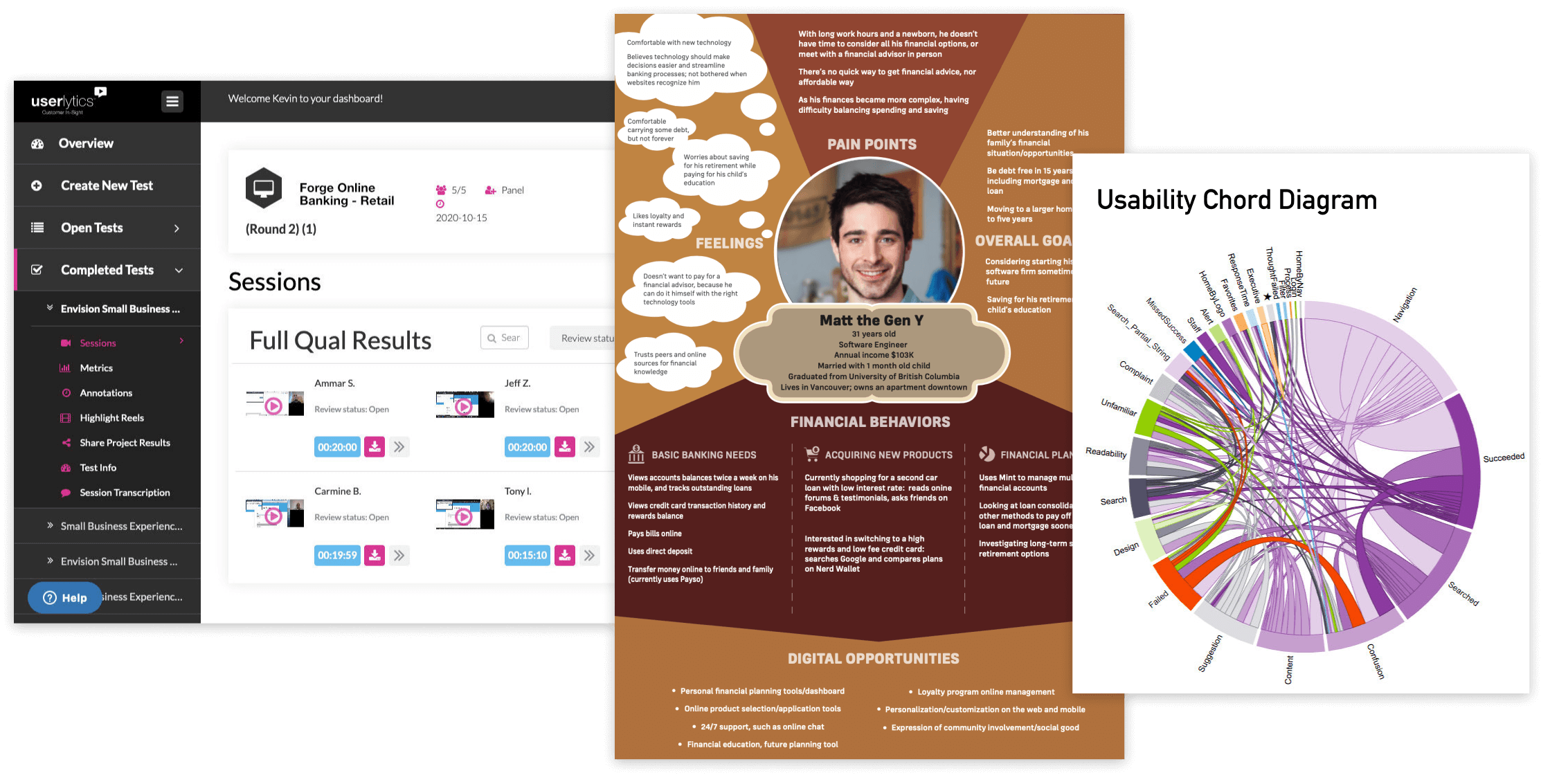

My role began with speaking with our users, gathering information about their needs and competitive intelligence.

I also consulted with project stakeholders including the product owner and the credit union partners, to determine what features are of particular importance to them and why, and also to determine what business or platform requirements must be respected.

My responsibility included ensuring that our products met accessibility guidelines. Ontario based credit unions must meet the WCAG 2.0 standard to comply with provincial disability laws, and a similar federal law is in the works. My team also provided accessibility recommendations for the credit unions to incorporate into their branding and content that they bring into the platform.

The template design was contracted to a design agency, and specific products and workflows were handled in-house such as security features like cross-platform login and two-factor authentication, and most of the business-oriented features.

I promoted a usability testing regimen and also regular design reviews to ensure new feature designs remained consistent with existing patterns.

Challenges Overcome

In a project of this scope the resource demands are enormous. The Personal and Small Business versions of Online Banking were being developed concurrently, and then the Corporate banking project schedule was accelerated during development, diverting needed resources.

At the height of the projects I was coordinating design input from four internal designers, two design agencies, designers from the platform vendor Backbase, additional designers from consulting firms and input from partner credit unions. I was managing UX and Accessibility resources across up to a dozen agile teams at once, ensuring that they received the attention that they needed.

To manage the design output in a project this complex I initiated a Design System project with the front-end developers agile chapter to establish a base library of design patterns, linked to the codebase in GitHub. This project adopted and expanded on deliverables from all of the aforementioned design sources.

To manage feedback and requests from various stakeholders I established a governance structure to rapidly respond to priority change requests from partners, and an Agile UX Chapter to coordinate work, ensuring consistent design approach across teams.

Results

The retail version of Online Banking went live with the first credit union partner in early 2020. It is now being rapidly adopted by other credit unions across the country.

Late stage testing showed that users we strongly positive with the new design directions, and found no significant usability issues in the UI.